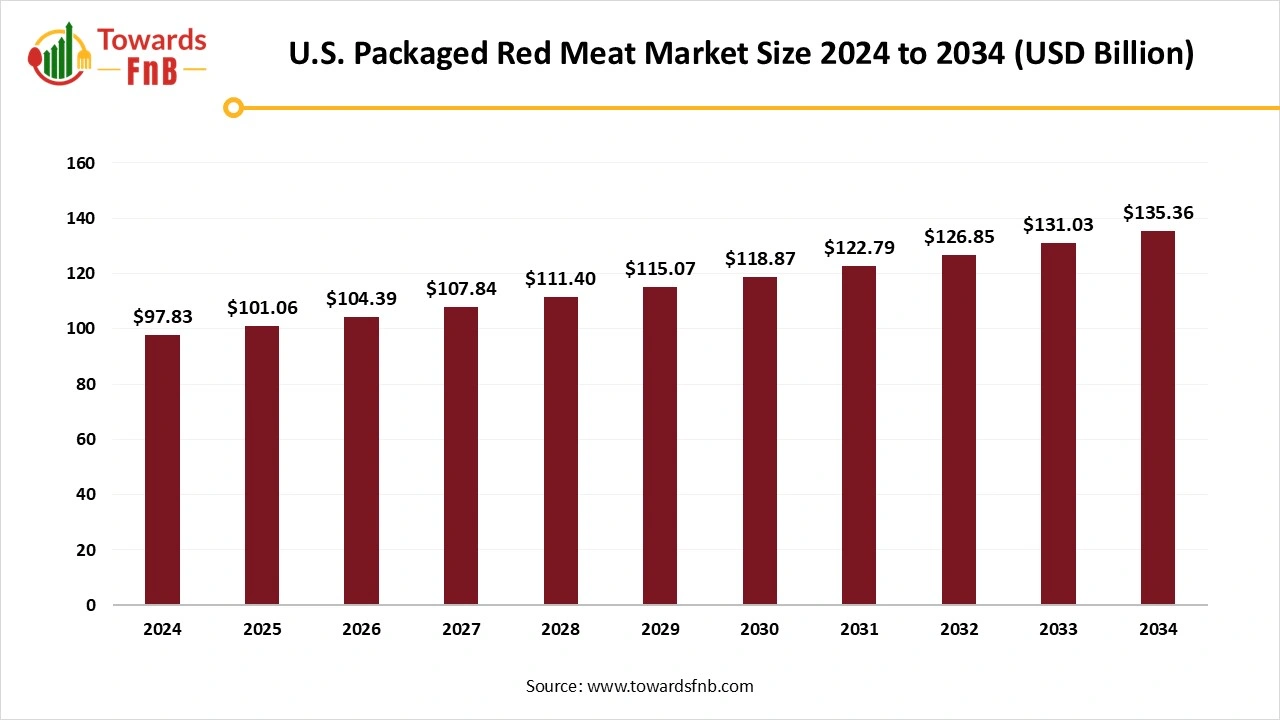

U.S. Packaged Red Meat Market Size to Reach USD 135.36 Billion by 2034, Driven by Premium Cuts and Online Growth

According to Towards FnB, the U.S. packaged red meat market size is projected to climb from USD 101.06 billion in 2025 to approximately USD 135.36 billion by 2034. This steady rise reflects a compound annual growth rate (CAGR) of 3.3% over the forecast period, supported by ongoing consumer demand for protein-rich foods, convenient packaging formats, and premium meat options.

Ottawa, Sept. 17, 2025 (GLOBE NEWSWIRE) -- The U.S. packaged red meat market size was valued at USD 97.83 billion in 2024. Building on this base, the market is expected to increase from USD 101.06 billion in 2025 to nearly USD 135.36 billion by 2034, according to a recent study published by Towards FnB, a sister company of Precedence Research.

The market has been experiencing growth in recent years, driven by the high demand for protein-rich foods among health-conscious consumers. The market is also burgeoning due to high demand for convenient food options and easy availability of red meat in convenient packaging.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5704

U.S. Packaged Red Meat Market Overview

The U.S packaged red meat market encompasses animal-based and plant-based products that are pre-cut, portioned, and processed and sold in sealed packaging format through different mediums and platforms. The market also encompasses different types of meat products derived from beef, pork, lamb, and veal, along with various other products derived from modern plant-based alternatives to replicate red meat.

Key Highlights of the U.S Packaged Red Meat Market

- By source animal-based, the beef segment led the U.S packaged red meat market with largest share of 42% in 2024, whereas the fully processed pork segment is expected to grow in the foreseen period.

- By processing level, the raw/unprocessed segment dominated the market with highest share of 45% in 2024, whereas the ready-to-heat cooked meat segment is observed to grow in the foreseen period.

- By labeling type, the conventional segment captured the maximum share of 63% in 2024, whereas the organic/grass-fed segment is observed to grow in the foreseen period.

- By brand ownership, the national brands segment led the U.S packaged red meat market with largest share of 62% in 2024, whereas the private label premium segment is expected to grow in the forecast period.

- By source, plant-based, the ground and burger format segment dominated the U.S packaged red meat market in 2024, whereas the marinated and cooked strips segment is expected to grow in the foreseen period.

- By packaging type, the vacuum-sealed segment dominated the U.S packaged red meat market with share of 39% in 2024, whereas the skin packaging segment is expected to grow in the expected timeframe.

- By distribution channel, the supermarkets/hypermarkets segment held the largest share of 48% in 2024, whereas the online DTC and e-commerce retailer segment is observed to grow in the foreseen period.

- By consumer type, the budget-conscious segment led the U.S packaged red meat market with highest share of 51% in 2024, whereas the health-conscious and sustainable buyers segment is expected to grow in the foreseen period.

A tight cattle cycle and accelerating adoption of skin packaging are reshaping the packaged red meat landscape,” said Vidyesh Swar, Principal Consultant at Towards FnB. “While beef remains dominant, online direct-to-consumer channels and premium private label programs are carving out faster growth.

Impact of AI in the U.S. Packaged Red Meat Market

Artificial intelligence (AI) is reshaping the U.S. packaged red meat market by improving efficiency, safety, and consumer engagement across the supply chain. In processing facilities, AI-powered robotics and computer vision systems automate tasks such as cutting, deboning, grading, and packaging, ensuring precision, reducing labor dependency, and minimizing errors. Machine learning models enhance food safety and quality control by detecting contamination, foreign objects, or inconsistencies in meat texture, color, and marbling, ensuring compliance with USDA regulations. AI-driven predictive analytics also optimize cold chain management by monitoring storage conditions and forecasting shelf life, reducing spoilage and extending the freshness of packaged products.

New Trends of the U.S Packaged Red Meat Market

- High demand for meats in different forms and packaging due to their high protein content and other nutritional elements, helpful for the growth of the U.S packaged red meat market.

- High demand for personalization and customization is also helping the growth of the U.S packaged red meat market. High demand for meat products on different platforms also helps the market grow.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/us-packaged-red-meat-market

Product Survey of the U.S Packaged Red Meat Market

| Product Type / Cut | Key Attributes / Features | Why It’s Important / What Drives Demand | Example Applications or Consumer Use |

| Ground Meat (Beef & Pork) | Highly versatile, often value-priced, usable in many formats (burgers, meatballs, tacos) | Convenience, cost efficiency, and high consumer demand for easy meal prep | Pre-formed burger patties, taco kits, frozen dinners, ready-to-cook mixes |

| Steaks & Roasts (Beef Cuts) | Premium cut, higher price per pound, strong flavor profile, appeal in fresh/chilled form | Consumers looking for premium/indulgence, grilling/entertaining, special-occasion meals | Ribeye, strip, filet, prime rib, pot roast |

| Ribs | Flavorful, often seen as premium, slower cooking cuts, smoked or barbecued | BBQ culture, restaurants, backyard grilling; flavor & texture appeal | Baby back ribs, spare ribs, beef short ribs, rib-eye ribs |

| Shank & Other Traditional Cuts (Beef & Lamb) | Less common, often used for stews, slow cooking, soups; may be lower cost per weight | Foodservice demand, comfort foods, cultural or regional cuisines | Osso buco, lamb shanks, beef shank soups, stews |

| Fresh / Chilled Red Meat Cuts | Minimally processed, kept at refrigerated temperatures, short supply chain from slaughter to shelf | Perception of freshness, natural flavor, less processing; “clean” label appeal | Steak, chops, fresh ground meat, portioned cuts |

| Frozen Red Meat Products | Frozen shortly after packaging, longer shelf life, seasonal balancing, enables distribution over longer distances | Helps stabilize supply, reduce waste, meet demand off-season; lower price points | Frozen steaks, frozen ground beef, frozen racks, frozen lamb or goat cuts |

| Processed / Fully Processed Meat (Sausages, Bacon, Hot Dogs, Packaged Processed Beef/Pork Products) | Includes cured, smoked, seasoned, marinated; often ready to cook or ready to eat | Convenience, flavor variety, snacking trends, value adds; appeals to time-pressed shoppers | Sausages, burger patties, bacon, deli meats, and ready-to-eat red meat snacks |

| Ethnic / Specialty Cuts (Lamb, Mutton, Goat, Imported Cuts, Organic / Grass-Fed) | Often premium or niche, certain cuts are culturally specific, possibly higher cost, unique taste profiles | Growing diverse population, demand for specialty/heritage meats, premium & organic trends | Goat meat packs, lamb racks, grass-fed beef steaks, and organic red meat portions |

Recent Developments in the U.S Packaged Red Meat Market

- In April 2025, the U.S. Meat Export Federation partnered with the USDA’s Foreign Agricultural Service and a Peruvian importer to introduce two U.S. red meat products. The products were introduced to media outlets and 70 retailers, processors, caterers, and institutional representatives in Lima. The launched products are affordable, easy-to-prepare meal options that are also rich in iron and protein. (Source- https://www.nationalhogfarmer.com)

- In May 2025, Jack Link's, a global leader in meat snacks and one of the largest privately owned food companies in the U.S, announced its launch of a new meat snack line with the world’s #1 social media creator, businessman, and philanthropist, MrBeast (Jimmy Donaldson). The main aim of the launch is to gain modern expertise in the traditional food industry. (Source- https://www.businesswire.com)

Market Dynamics

What Are the Growth Drivers of the U.S Packaged Red Meat Market?

High demand for protein and other essential nutrients for the overall well-being of the body has helped the growth of the U.S packaged red meat market. Packaged meat allows consumers to manage their hectic lifestyles while maintaining the nutritional levels as well. Technological advancements, high demand for organic meat, and improved online platforms are also some of the drivers helpful for the growth of the U.S packaged red meat market. The growth of health-conscious consumers and consumers with high disposable incomes also helps the growth of the market.

Challenge

Meat Contamination Is Lowering the Growth of the Market

U.S. Department of Agriculture's Food Safety and Inspection Service (FSIS) stated that ground beef is more prone to getting contaminated with E coli O157:H7. Hence, such issues are aware consumers about their choices and may also make them skeptical to buy such products from the market, leading to restricting the growth of the U.S packaged red meat market.

Opportunity

Meatpacking Is Helping the Growth of the Market in the Region

Meatpacking is a huge business in the region, which is helpful for the market to grow in the foreseeable period. Huge companies in the industry try to provide secure, nutritious, and cultivated meat to consumers. The companies also pay attention to providing sustainable food products in sustainable packaging at affordable prices, which is helpful for the growth of the market. It also helps the market grow in the foreseeable period.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/price/5704

Country Level Analysis

The US government has taken health initiatives by lowering the intake of processed meat. Beef consumption has grown in the market in recent years due to its high protein levels and other nutrient factors helpful for the overall health of consumers. The USDA has updated the vital regulations to manage the increasing political spending on the meat industry. U.S. Customs and Border Protection also stated that the meats, fruits, plants, seeds, vegetables, soil, and animals should be declared by all travelers entering the U.S.

U.S. Packaged Red Meat Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 3.3% |

| Market Size in 2024 | USD 97.83 Billion |

| Market Size in 2025 | USD 101.06 Billion |

| Market Size by 2034 | USD 135.36 Billion |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

U.S. Packaged Red Meat Market Segmental Analysis

Animal-Based Source Analysis

The beef segment dominated the U.S packaged red meat market in 2024 due to high demand for beef in the region. Beef is a rich source of protein, vitamin B12, vitamin B6, niacin, riboflavin, and various other essential nutrients helpful for muscle growth, muscle repair, tiredness, and fatigue. Hence, it is highly demanded in the region, helpful for the growth of the U.S packaged red meat market. It is also a rich source of zinc, helpful for supporting overall health and well-being. Beef is also helpful to strengthen immunity, improve fertility, balance testosterone levels, and manage the overall body.

The fully processed pork segment is observed to grow with the highest CAGR in the foreseen period, as the form of meat is rich in protein, vitamin B6, vitamin B12, niacin, iron, zinc, and various other essential nutrients. Hence, the source of protein is helpful for muscle growth, muscle repair, and overall fitness of the body, further fueling the growth of the U.S packaged red meat market in the region.

Processing Level Analysis

The raw/unprocessed segment led the U.S packaged red meat market in 2024, as such a form of food options helps to retain enzymes, aid in weight loss, help to improve maximum skin conditions, and provide higher energy and better digestion as well. Food options such as dried fruits and vegetables, soaked and sprouted beans, legumes, nuts, and various other similar food options are ideal for a raw/unprocessed diet. Raw eggs, raw meat, non-pasteurized and non-homogenized milk are also ideal options to follow an unprocessed diet. Hence, the segment helped to fuel the growth of the market in 2024.

The ready-to-heat cooked meat segment is expected to grow in the foreseen period due to its convenience, which is helpful for busy consumers managing hectic schedules. Such food options also help to lower food wastage, are effective, and are also helpful to save time. Patients in their recovery period can opt for such food options to manage their diet easily. Hence, the segment helps to fuel the growth of the U.S packaged red meat market in the foreseeable period.

Labeling Type Analysis

The conventional segment led the U.S packaged red meat market in 2024 due to its high demand by consumers in the region. Conventional labeling helps to provide detailed information about the product to the consumers. Hence, it helps consumers to understand and study the nutritional levels of the food item in detail. Such labels also help with brand identification, consumer trust, safety, and legality. Such labels help consumers to provide information about the product and its proper usage. Hence, the segment led the U.S packaged red meat market in 2024.

The organic/grass-fed segment is observed to grow in the foreseen period, as organic labeling or seal is essential for organic products. Such forms of labels are attained after they go through an organic certification process. Hence, the segment is observed to grow in the foreseen period.

Brand Ownership Analysis

The national brands segment led the U.S packaged red meat market in 2024 because the platform offers reduced marketing expenses, a high level of customer loyalty, high customer trust, and television promotion. It helps to enhance the brand image and allow repetitive purchases by consumers, which is helpful for the growth of the market.

The private label premium segment is expected to grow in the expected timeframe due to its high profit margin, high volume and sales, along with better and enhanced control of the supply chain. Such segments perform research and development to understand consumer behavior and manage the manufacturing accordingly.

Plant-Based Source Analysis

The ground and burger format segment led the U.S packaged red meat market in 2024 because of its high nutritional content, such as high protein, vitamins, minerals, zinc, and other enzymes. Such essentials help in muscle growth, repair, and endurance strength as well, which is helpful for overall well-being. The whole meal can be made healthier by adding whole wheat buns and a lot of vegetables. Such food options can also be customized to enhance the nutrients of the meal and manage the fat content as well. Hence, the segment helps to draw more consumers for the growth of the U.S packaged red meat market.

The marinated and cooked strips segment is observed to grow in the foreseen period, as the segment highlights the juiciest and tenderest meat strips. Such meat options are enriched with health benefits along with taste, helpful to aid the growth of the market in the foreseeable period.

Packaging Type Analysis

The vacuum-sealed segment led the U.S packaged red meat market in 2024, as it helps to avoid microbial growth, oxygen, and contamination as well. Such food options have enhanced shelf-life, occupy less space, are easy to store, and are also protected from freezer burns. Such a form of packaging is essential for food options like perishables, dry goods, and cooked foods, to enhance their shelf life.

The skin packaging segment is expected to grow in the foreseen period as the form of packaging helps to extend the shelf life of food products, aids cost reduction, and enables production planning. It also helps to manage situations such as staff shortage and lower operational costs.

Distribution Channel Analysis

The supermarkets/hypermarkets segment led the U.S packaged red meat market in 2024, as such places have a separate section for dedicated products to allow consumers to spot them easily. They are arranged in an attractive form to allow consumers to shop easily and to shop for various other types of products as well. Hence, the segment led the U.S packaged red meat market in 2024.

The online DTC and retailer e-commerce segment is expected to grow in the foreseeable period as the segment provides increased profit margins, deeper customer relationships, and enhanced options for personalization and customization. The platform also provides detailed consumer data and allows for enhancing the online experience of consumers as well.

Consumer Type Analysis

The budget-conscious segment led the U.S packaged red meat market in 2024, as such consumers allow businesses to maintain convenience, provide guidance, and promote deals. Consumers also use social media platforms to promote their economic products for consumers to buy them easily. Hence, the segment led the U.S packaged red meat market in 2024.

The health-conscious and sustainable buyers segment is observed to grow in the foreseen period due to consumer awareness for high demand of products that are low in sugar, low in calories, and maintain sustainability as well. Hence, the segment also highlights the demand for sustainable and functional foods helpful for the growth of the market.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- India Flavored Milk Market: The India flavored milk market size is forecasted to expand from USD 345.96 million in 2025 to USD 560.13 million by 2034, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Soybean Seed Market: The global soybean seed market size is projected to expand from USD 11.37 billion in 2025 to USD 21.09 billion by 2034, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034.

- Wheat Protein Market: The global wheat protein market size is forecasted to reach from USD 7.69 billion in 2025 to USD 11.43 billion by 2034, expanding at a CAGR of 4.5% during the forecast period from 2025 to 2034.

- Gummy Supplements Market: The global gummy supplements market size is expected to grow from USD 7.29 billion in 2025 to USD 13.63 billion by 2034, at a CAGR of 7.2% over the forecast period from 2025 to 2034.

- Pulse Ingredients Market: The global pulse ingredients market size is forecasted to expand from USD 23.24 billion in 2025 to USD 30.86 billion by 2034, growing at a CAGR of 3.2% during the forecast period from 2025 to 2034.

- Essential Oil Market: The global essential oil market size is expected to grow from USD 28.24 billion in 2025 to USD 61.83 billion by 2034, at a CAGR of 9.1% over the forecast period from 2025 to 2034.

- Compound Feed Market: The global compound feed market size is expected to grow from USD 614.57 billion in 2025 to USD 986.58 billion by 2034, at a CAGR of 5.4% over the forecast period from 2025 to 2034.

- Bakery Premixes Market: The global bakery premixes market size is forecasted to expand from USD 456.8 million in 2025 to USD 763.2 million by 2034, growing at a CAGR of 5.96% during the forecast period from 2025 to 2034.

- Sweeteners Market: The global sweeteners market size is forecasted to expand from USD 113.17 billion in 2025 to USD 156.26 billion by 2034, growing at a CAGR of 3.65% during the forecast period from 2025 to 2034.

- Functional Food Ingredients Market: The global functional food ingredients market size is forecasted to expand from USD 127.48 billion in 2025 to USD 232.40 billion by 2034, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034.

Top Companies in the U.S. Packaged Red Meat Market:

- Cargill Inc – A leading U.S. agribusiness giant producing beef, pork, and value-added red meat products with strong global supply chain integration.

- JBS S.A. – Brazil-based, the world’s largest meat processor, with a major U.S. presence in beef, pork, and packaged red meat brands.

- Tyson Foods – One of the largest U.S. meat companies, supplying beef, pork, and prepared red meat products for retail and foodservice.

- National Beef – A top U.S. beef processor specializing in boxed beef, branded beef programs, and packaged red meat solutions.

- BRF SA – A Brazilian multinational producing beef, pork, and packaged meat products, with growing exports to North America.

- WH Group Limited – World’s largest pork company (parent of Smithfield Foods), producing packaged pork and red meat products for U.S. and global markets.

- Hormel Foods Corporation – U.S. food company known for branded packaged meats like Spam, pepperoni, bacon, and deli meats.

- Marfrig Global Foods SA – A Brazilian beef giant with operations in North and South America, producing packaged beef for retail and foodservice.

- Smithfield Foods – A U.S. leader in pork processing and packaged pork products, owned by WH Group.

- Bavarian Meats – Seattle-based specialty producer of German-style sausages and packaged cured meats.

- Conagra Brands – U.S. packaged food company offering frozen and shelf-stable red meat meals under brands like Banquet and Healthy Choice.

- Dubuque Packing Company – Formerly a major U.S. meatpacker, known historically for beef and pork products (brand legacy continues under different ownership).

- Pilgrim's Pride Corporation – A large U.S. poultry processor (owned by JBS) with some overlap into packaged meat solutions.

- Seaboard Corporation – U.S. agribusiness and pork producer with significant pork processing and packaged meat exports.

-

Tyson Fresh Meats, Inc. – Tyson’s beef and pork division, supplying fresh and packaged red meat to retailers, processors, and foodservice.

Segments Covered in the Report

By Source

Animal-Based Packaged Red Meat

By Species

- Beef

- Fully Processed Pork

- Lamb

- Veal

- Blended/Combo Meats

By Processing Level

- Raw / Unprocessed

- Minimally Processed

- Fully Processed

- Ready-to-Heat Cooked Meats

By Labeling Type

- Conventional

- Organic/Grass Fed

- Grass-Fed / Pasture-Raised

- Antibiotic-Free / Hormone-Free

- Halal Certified

- Kosher Certified

By Brand Ownership

- National Brands

- Private Label Premium

- Premium / Specialty Brands

Plant-Based Packaged Red Meat Alternatives

By Base Ingredient

- Pea Protein

- Soy Protein

- Mushroom-Based

- Wheat Protein / Seitan

- Vegetable-Based Blends

By Product Format

- Ground and Burger Format

- Patties and Burgers

- Sausages and Hot Dogs

- Meatballs and Crumbles

- Marinated and Cooked Strips

- Cooked Strips and Slices

By Branding

- National Brands

- Private Label Brands

- Foodservice Extensions

By Label Claims

- Non-GMO

- Organic

- Vegan Certified

- Gluten-Free

- Clean Label

By Packaging Type

- Vacuum-Sealed

- Modified Atmosphere Packaging (MAP)

- Tray Pack (Shrink-Wrapped)

- Skin Packaging

- Sustainable / Compostable Packaging

By Distribution Channel

- Supermarkets and Hypermarkets

- Club Stores

- Discount Retailers

- Specialty Butcher Chains

- Online DTC and Retailer E-Commerce

- Direct-to-Consumer (DTC) Subscriptions

By Consumer Type

- Budget-Conscious

- Premium Shoppers

- Health-Conscious and Sustainable Buyers

- Ethical / Sustainable Shoppers

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/price/5704

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies |

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Confectionery Ingredients Market: https://www.towardsfnb.com/insights/confectionery-ingredients-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️Poultry Feed Market: https://www.towardsfnb.com/insights/poultry-feed-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Plant-Based Protein Market: https://www.towardsfnb.com/insights/plant-based-protein-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Food Additives Market: https://www.towardsfnb.com/insights/food-additives-market

➡️Baking Ingredients Market: https://www.towardsfnb.com/insights/baking-ingredients-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Dairy Processing Equipment Market: https://www.towardsfnb.com/insights/dairy-processing-equipment-market

➡️Meat Products Market: https://www.towardsfnb.com/insights/meat-products-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Seed Coating Materials Market: https://www.towardsfnb.com/insights/seed-coating-materials-market

➡️Precision Fermentation Market: https://www.towardsfnb.com/insights/precision-fermentation-market

➡️Pet Dietary Supplements Market: https://www.towardsfnb.com/insights/pet-dietary-supplements-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.