Health and Wellness Market Size Worth USD 11 Trillion by 2034

The health and wellness market size is expected to be worth over USD 11 trillion by 2034, increasing from USD 6.57 trillion in 2024, with a CAGR of 5.50%. The market of health and wellness is driven by rising health awareness, an aging population, technological advancements, growing health consciousness, and supportive government initiatives.

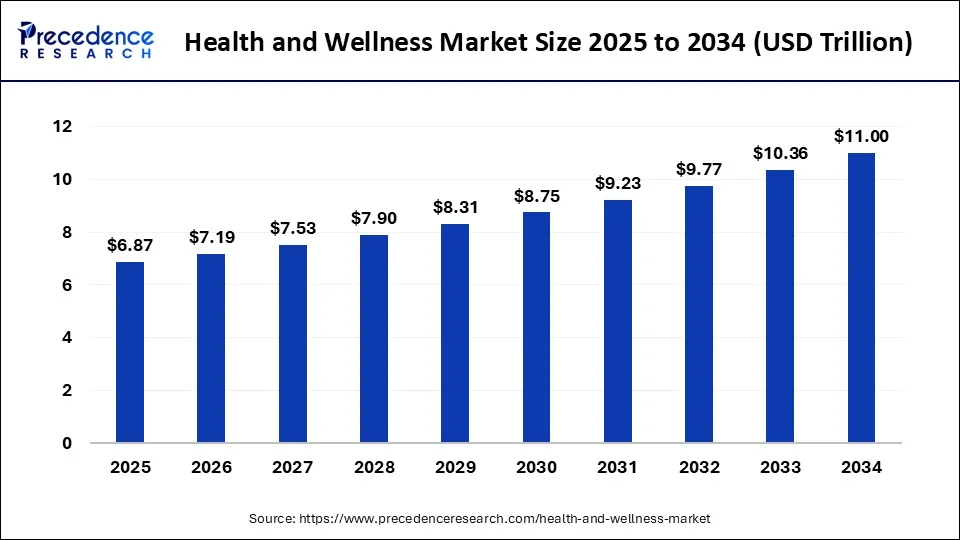

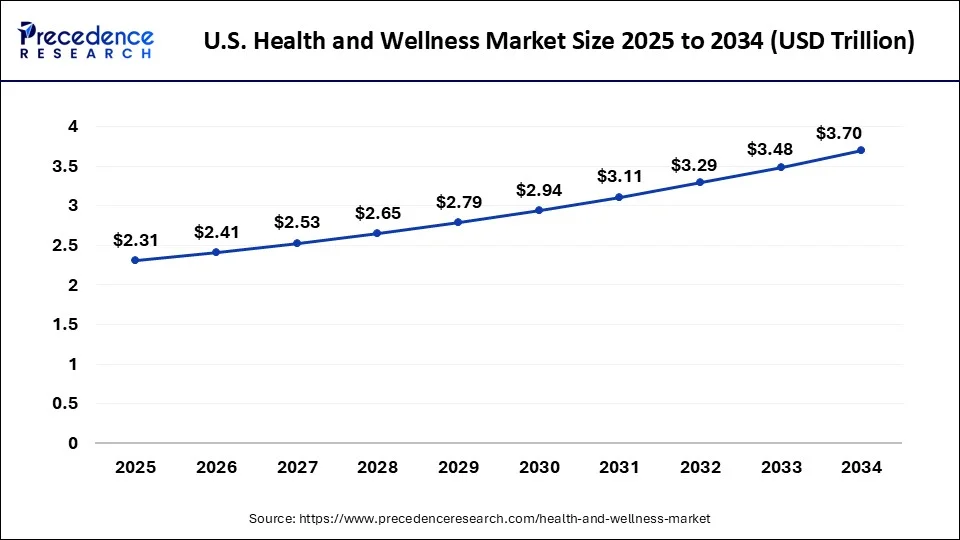

Ottawa, June 24, 2025 (GLOBE NEWSWIRE) -- According to Precedence Research, the global health and wellness market size valued at USD 6.87 trillion in 2025 and is projected to reach USD 11 trillion by 2034, growing at a CAGR of 5.40% from 2025 to 2034. North America held a 38.04% share in 2024, with the U.S. market expected to grow from USD 2.21 trillion to USD 3.70 trillion by 2034. The integrated wellness and personal care services sector led the market with 21.72% of the share in 2024. The Asia Pacific region is set to grow at the fastest rate.

The dynamic trends in consumer behaviour, technological innovations, healthcare policies, and societal values are the major trends shaping the health and wellness industry.

The Complete Study is Now Available for Immediate Access - Download Sample Pages and Explore Now@ https://www.precedenceresearch.com/sample/1352

Health and Wellness Market Revenue Analysis by Sector (USD Billion)

| Sector | 2022 | 2023 | 2024 |

| Healthy Eating, Nutrition & Weight Loss | 860.9 | 909.1 | 962.5 |

| Wellness Tourism | 774.2 | 817.1 | 864.4 |

| Preventive, Personalized Medicine & Public Health | 710.4 | 753.6 | 801.2 |

| Physical Activity | 1,034.1 | 1,080.7 | 1,132.3 |

| Integrated Wellness & Personal Care Services | 1,326.7 | 1,374.4 | 1,427.5 |

| Others | 1,349.5 | 1,365.2 | 1,383.5 |

Health and Wellness Market Key Highlights:

- In terms of revenue, the health and wellness market was valued at $ 6.57 trillion in 2024.

- It is projected to cross $ 11 trillion by 2034.

- The market is expected to grow at a CAGR of 5.40% from 2025 to 2034.

- North America held the largest market share of 38.04% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR between 2025 and 2034.

- The integrated wellness and personal care services segment dominated the market with the highest share of 21.72% in 2024.

Get the Latest Market Intelligence – Order Your Research Report Today! Immediate Delivery Available https://www.precedenceresearch.com/checkout/1352

What is the Remarkable Potential of Health and Wellness Platforms?

The health and wellness market is the rapidly growing industry that revolves around several products and services for the overall physical, mental, and social well-being. A wide range of services are related to personal care, beauty, weight management, nutrition, mental wellness, and fitness. Furthermore, a growing trend of wellness tourism, personalized and preventive health, and active lifestyle accelerates the growth of the health and wellness industry.

The potential consumers are moving towards various products such as clean beauty brands, organic skincare, protein powders, vitamins, meal kits, and many more to achieve a good hygiene, skincare, nutrition, and fitness. The growing shift towards meditation applications, therapy platforms, telehealth, spa retreats, and wearables drives the expansive reach of the market.

- In March 2024, the Office of the National Coordinator for Health Information Technology prepared a ‘Federal Health IT Strategic Plan’ for 2024-2030 which aims to improve the health and well-being of communities and individuals by using technologies and health information that will be accessible in required situations.

Also Read: Exploring the Hidden Forces Behind the Global Skincare Market Boom

Health and Wellness Products Introduced by Prominent Players:

| Sr. No. | Name of the Product | Name of the Brand | Product Specification |

| |

Nature’s Bounty® Intimacy Booster Nature’s Bounty® Healthy pH Balance Nature’s Bounty® Hair Growth Gummies |

Nature’s Bounty® of Nestle |

The new products target women’s wellness for hair growth, sexual health, and vaginal pH balance. |

| 2. |

One A Day® Age Factor™ Cell Defense Dietary Supplement | One A Day® of Bayer AG | To support cellular aging and cellular health. |

| 3. | Rénergie Nano-Resurfacer | Lancôme of L'Oréal SA | To protect skin against the visible signs of aging, driven by nanotechnology. |

| 4. | A portfolio of vitamins, minerals, and supplements, especially neurotrophic vitamins | Procter & Gamble Health Ltd. | A five-year plan to augment the company’s portfolio. |

Also Read: Vitamin Supplements Market to Reach USD 99.78 Bn by 2034: Key Drivers and Trends

Major Trends in the Health and Wellness Market

How does the Growing Shift Towards Organic and Clinically Proven Products Drive the Global Health and Wellness?

-

Health Management at Home: People are turning towards home-based testing kits for the diagnosis, detection, and treatment of their health conditions. The major rationales behind this are pandemic and epidemic cases which cause the increased need for molecular biology testing kits, vaccines, testing appliances, etc. With the help of these advanced solutions, individuals can test their vitamin and mineral deficiencies, measure cholesterol levels, and detect flu and cold symptoms at home. Due to busy work schedules and the tedious lifestyles of people, they prefer at-home care by avoiding personal visits to hospitals and doctors.

- The rapid and remote healthcare services are in high demand which saves time, operational costs, traveling headaches, etc. by maintaining a work-life balance. The countries like United States and the United Kingdom are offering at home healthcare appointments, routine checkups, remote patient monitoring, and remote medical services which improve convenience to people for accessing at-home diagnosis and treatment.

-

Increased Preferences for Clinically Proven Products: In recent years, a major shift was observed for clinically proven ingredients rather than only natural or clean wellness products. Clinical effectiveness is the top purchasing factor for U.S. and UK consumers while only 20% accounts for natural or clean health ingredients. In China, people prefer both natural and clinically proven products equally. A trend of clinical efficacy is usually growing to achieve digestive medication, eye care products, and topical treatments. The natural products are usually preferred for superfoods, supplements, and personal care products.

- In August 2023, McKinsey & Company reported data of U.S. consumers adopting the clinical efficacy or clinically proven products than preferring natural/organic formulas or natural/organic products. The high percentage rates were observed for products with clinically proven efficiency that are related to nutrition, beauty, consumer goods, vitamins and supplements, and over-the-counter drugs.

- In the U.S. women highly purchase and adopt healthcare products which include menstrual care products, sexual health products, period-or-fertility tracking applications, menopause products, fertility devices, and pregnancy/post-partum products.

Also Read: From Vitamins to Botanicals: Understanding the Growth of Dietary Supplements

Which Potential Factors Impose Significant Concerns related to the Market’s Growth?

-

Limitations Associated with Employee Wellness Programs: The major rationales behind the lack of participation of employees in these programs are privacy concerns, a lack of interest, insufficient knowledge of the program’s benefits, and inadequate time. Moreover, the heavy initial investments in lots of resources by the employers may lag in maintaining their sustainability for a long time.

-

Challenges Related to Malnutrition, Sanitation, and Hygiene: Malnutrition is one of the prominent challenges in India. Nearly, 50% of children in India suffer from this challenge and stay undernourished. It not only affects their physical health but also their cognitive development and long-term productivity. A lack of safe sanitation and hygiene facilities in some areas causes the spread of severe diseases such as typhoid, cholera, and diarrhea.

Also Read: Understanding the Molecular Biology Enzymes & Kits Market: A Comprehensive Overview

Health and Wellness Market Focus

| Report Attribute | Key Statistics | |

| Market Size in 2024 | $ 6.57 Trillion | |

| Market Size in 2025 | $ 6.87 Trillion | |

| Market Size in 2030 | $ 8.75 Trillion | |

| Market Size in 2032 | $ 9.77 Trillion | |

| Market Size by 2034 | $ 11 Trillion | |

| CAGR 2025-2034 | 7.33% | |

| Dominant Region in 2024 | North America | |

| Fastest Growing Region | Asia Pacific | |

| Base Year | 2024 | |

| Historic Years | 2020-2023 | |

| Forecast Years | 2025-2034 | |

| Segment Covered | Type, Products, Services, and Regions | |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa | |

| Key Drivers | Technological advancements, growing demand in emerging markets, increasing consumer preference for innovation | |

| Market Trends | Shift towards digital transformation, rise of sustainable solutions, increased investment in R&D across sectors | |

| Market Opportunities | Expanding markets in Asia-Pacific, adoption of new services and technologies, increasing demand for personalized products | |

| Challenges | Regulatory hurdles, supply chain disruptions, competitive pressures in mature markets | |

| Competitive Landscape | Key players, market share analysis, competitive strategies, mergers, and acquisitions | |

Set up a meeting at your convenience to get more insights instantly! https://www.precedenceresearch.com/schedule-meeting

How Big is the Development of Health and Wellness Platforms?

The United Nations holds sustainable development goals that aim to achieve no poverty, zero hunger, good health and well-being, quality education, gender equality, etc. Moreover, these goals also aim to provide people with clean water and sanitation, affordable and clean energy, and many other accessible facilities.

- According to the Impact Report 2024 by Bayer AG and one of the largest surveys on attitudes of people towards emerging technologies, more positive perceptions were observed from people who know more efficiently about technologies. This observation concludes that the innovations must be bold and clearly communicated. The survey also suggests that the establishment of trust and assurance of transparency are required to advance science for the planet and its people.

Source: https://www.bayer.com/sites/default/files/2025-03/bayer-impact-report-2024.pdf

Which Region Held the Dominating Share in Health and Wellness Market?

North America dominated the health and wellness market in 2024. The U.S. Department of Health and Human Services and the Office of Disease Prevention and Health Promotion present national health initiatives. The U.S. Centers for Disease Control and Prevention (CDC) presented national health initiatives, strategies, and action plans. The CDC holds the national plan to address Alzheimer’s disease and the Healthy Brain Initiative.

- In July 2024, Nutritional Growth Solutions Limited, the U.S.-based health, nutrition, and wellness company, entered into the Intellectual Property License Agreement (“IP License Deed”) with The Healthy Chef Pty Ltd. (“The Healthy Chef”) to expand the production and distribution of The Healthy Chef® products in the United States and Canada in the North America region.

Also Read: AI Meets Wellness: The Digital Transformation of Health Coaching

How Does the United States Lead in Health Sector with its Healthcare Initiatives?

The U.S. Department of Health and Human Services (HHS) is committed to providing high-quality and affordable healthcare. It is also dedicated to supporting and implementing programs that are organized to enhance the health, safety, and well-being of the American people.

The various agencies working in collaboration with the HHS focus on improving behavioral health, child well-being, emergency preparedness, equity, and maternal health. Some of the departments administering the HHS programs are the Indian Health Service (IHS), the National Institute of Health (NIH), the Centers for Disease Control and Prevention (CDC), the Centers for Medicare and Medicaid Services (CMS), the Health Resources and Services Administration (HRSA), etc.

- In November 2024, the Government of Canada announced the launch of the Youth Mental Health Fund which will support community organizations and deliver better mental health services for youth across Canada.

- In November 2024, the Government of Canada announced the launch of the Youth Mental Health Fund which will support community organizations and deliver better mental health services for youth across Canada.

Also Read: Future of Work: How Corporate Wellness is Shaping Workplace Culture

How Big is the U.S. Health and Wellness Market?

According to Precedence Research, the U.S. health and wellness market was valued at USD 2.21 trillion in 2024. It is projected to reach approximately USD 3.70 trillion by 2034, growing at a CAGR of 5.40% from 2025 to 2034.

The U.S. Health and Wellness Market Research Report is Readily Available for Immediate Delivery https://www.precedenceresearch.com/checkout/3883

How is the Opportunistic Rise of the Asia Pacific in Health and Wellness Market?

Asia Pacific is expected to grow at the fastest CAGR in the health and wellness market during the forecast period due to various initiatives taken by different countries to drive innovations. With the growing aging population in Asia, the need for nurses and care workers is also increasing. For long-term healthcare and treatment plans, some countries are expanding their capabilities through the employment of nurses.

Also Read: Strategies for Overcoming Healthcare Staffing Challenges in 2025

How is the Prestigious Move of Thailand and Japan?

In January 2025, the 4th Healthy Aging Prize for Asian Innovation (HAPI) was organized and more than 150 people were present to celebrate the winners in Bangkok. The awards were presented by the president of the Japan Center for International Exchange (JCIE), and the Senior Policy Fellow on Healthcare at the Economic Research Institute for ASEAN and East Asia (ERIA). The HAPI aims to address and implement innovative policies, services, products, and programs to help the aging society to live healthy and prosperous lives.

- In June 2024, Nestle Health Science announced the launch of its innovative GLP-1 nutrition web platform. This launch will be a supportive guide for people using GLP-1 medications and going through their weight management strategies.

- In February 2025, Bayer AG introduced its One A Day Bayer Men's Complete Multivitamin Tablet which is a supportive supplement for men approaching or crossing their 50s.

How Big is the Success of the European Health and Wellness Market?

Europe is leading with the success in nutrition and wellness foods by achieving massive growth in Organic and clean-label foods, Plant-based products (e.g., meat alternatives, oat milk), Functional foods (e.g., probiotics, immunity drinks). Europe leads with top markets such as Germany, UK, Netherlands, and France. It is prominent in fitness and personal wellness with the rise of hybrid models, in-person + app-based coaching (e.g., Freeletics, Urban Sports Club), boutique fitness (yoga, Pilates, HIIT) and home gym equipment sales remain strong.

Also Read: Understanding the Dynamics of the Wellness Supplements Industry

How Crucial is the Role of Latin America in Health and Wellness?

Latin America is successive due to natural products and supplements along with the growing preference for clean-label, plant-based, and organic products. There is a surge driven by rising lifestyle-related to digital health and apps. There is a strong momentum in fitness, meditation, and telehealth apps; Brazil leads app revenue growth, while digital devices are scaling up fast.

How does Middle East and Africa Lead the Health and Wellness Market?

MEA leads due to success in wellness and medical tourism. Africa and Middle East destinations (e.g., Namibia, South Africa, Botswana, UAE, Morocco, Oman) are specializing in nature-based retreats and luxury wellness escapes. New luxury wellness projects like Amaala in Saudi Arabia (Clinique La Prairie, Six Senses) aim for completion starting in 2025.

Also Read: Wearables and AI: Shaping the Future of Digital Health in U.S.

Health and Wellness Market Segmentation Analysis

By Type Analysis

Products: The products segment dominated the health and wellness market in 2024. The nutritional products such as dietary supplements, functional foods, superfoods, herbal remedies, etc. drive the expansion of the health and wellness products.

The availability of a wide range of products like multivitamins, omega-3s, probiotics, magnesium, vitamin D, protein bars, meal replacement shakes, energy snacks, etc. accelerate the segmental growth in the market. Furthermore, products and services such as melatonin, magnesium glycinate, weighted blankets, sleep tracking devices, aromatherapy diffusers, stress balls, adaptogenic teas, etc. boost mental health and emotional wellness.

Services: The services segment is expected to grow at the fastest CAGR in the health and wellness market during the forecast period. Several health and wellness services are associated with fitness, physical wellness, mental health, and emotional wellness that surge segmental growth in the global market.

Moreover, the services related to nutrition, lifestyle coaching, beauty, spa, and personal care also gained popularity among global end users. The corporate and community programs, and preventive health and diagnostics support the global reach of these health and wellness platforms.

By Product Analysis

Vitamins and Dietary Supplements: The vitamin and dietary supplements segment dominated the health and wellness market in 2024. The intake of multivitamin and minerals increases the intake of nutrients, vitamins, and minerals in proper amounts when people cannot meet these needs from regular diets. Research studies suggest that people who take these dietary supplements experience improved health and can stay away from the risk of developing chronic diseases than people who do not take these supplements.

Research studies also suggest that these minerals and vitamin supplements reduce the risk of developing cancer or improve the outcomes of cancer treatment. The nutrients like vitamins and minerals inhibit carcinogenesis or tumor progression and elicit a strong immune response among cancer patients or healthy individuals.

Weight Loss: The weight loss products segment is expected to grow at the fastest CAGR in the health and wellness market during the predicted timeframe. The suitability of weight loss products like prescription weight loss drugs for long-term use rather than placebo treatment drives their importance in the healthcare market.

The assistance of regular medical supervision and guidance during medical check-ups and consultations results in psychological benefits and effectiveness in treatments. The major roles of weight loss drugs as weight loss boosters prove to be encouraging and advantageous for obese people.

Healthy Diet: The healthy diet segment is another notable segment in the health and wellness market. A healthy diet is foundational to health and wellness, supporting physical energy, mental clarity, immune strength, and long-term disease prevention.

The ideal diet varies slightly by age, lifestyle, and health goals, but it generally includes balanced macronutrients, micronutrient-dense foods, and minimal processed ingredients.

Sports Nutrition: The sports nutrition segment is also seen to grow notably in the health and wellness market. Sports nutrition helps people to understand the nutritional needs, especially of athletes and sportspeople. It helps to find a perfect balance of nutrients that supply energy and stamina to perform sports. It provides proper advice to athletes about their correct timings of nutrient intake to improve performance and health.

By Service Analysis

Fitness, Centres, Equipment and Programs: The fitness centres, equipment and programs segment dominated the health and wellness market in 2024. The various benefits of high-quality gym equipment such as reliability, enhanced safety, durability, and superior user experience drive gym enthusiasts towards fitness centers.

The reduced need for equipment maintenance and cost-savings offered by fitness programs and centers boost their expansion among individuals. The tremendous benefits of proper consultations and guidance related to mental, social, and physical well-being accelerate the expansive reach of fitness centers, equipment, and programs.

Healthy Food Delivery: The healthy food delivery segment is expected to grow at the fastest CAGR in the health and wellness market during the forecast period. The availability of several healthcare professionals specializing in nutrition such as registered dietitians, specialized nutrition specialists, dietetic technicians, and certified dietary managers helps to offer beneficial nutrition services.

The other healthcare staff such as pharmacists, registered nurses, and physicians also play prominent roles in healthcare and nutrition. The multidisciplinary team approach delivers promising, authentic, effective services, and treatments.

Nutrition Services: The nutrition services segment is another notable segment in the health and wellness market. The nutrition services including several health supplements are popular among people having allergic responses to components in prescription drugs. They lower the risk of side effects, offer relief from symptoms, are available in cost-effective forms, and are readily available. They treat chronic conditions, support digestive health, provide natural antioxidants, and promote overall wellness.

Sleep and Mental Wellness: The sleep and mental wellness segment is also seen to grow notably in the health and wellness market. Sleep and mental wellness are deeply interconnected—poor sleep can harm your mental health, while mental health issues can disrupt sleep. Optimizing both is essential for overall well-being, emotional balance, and cognitive performance.

Related Topics You May Find Useful:

- The global cellular health screening market size was valued at USD 3.46 billion in 2024, accounted for USD 3.73 billion in 2025, and is expected to reach around USD 7.46 billion by 2034, expanding at a CAGR of 8% from 2024 to 2034

- The global wellness genomics market size was estimated at USD 25.83 billion in 2024 and is predicted to increase from USD 29.52 billion in 2025 to approximately USD 95.56 billion by 2034, expanding at a CAGR of 13.98% from 2025 to 2034.

- The global wellness apps market size is estimated at USD 11.18 billion in 2024, and is projected to hit around USD 12.87 billion by 2025, and is anticipated to reach around USD 45.65 billion by 2034, expanding at a CAGR of 15.11% between 2025 and 2034.

- The global health coach market size accounted for USD 17.46 billion in 2024 and is anticipated to reach around USD 33.09 billion by 2034, expanding at a CAGR of 6.60% between 2024 and 2034.

- The global consumer healthcare market size was calculated at USD 330.89 billion in 2024 and is expected to hit around USD 708.44 billion by 2034, growing at a CAGR of 7.91% from 2025 to 2034.

Health and Wellness Market Top Companies

-

Nestle Health Science: A prominent player in medical nutrition and supplements.

-

Herbalife Nutrition: It leads with the notable brands and products like Herbalife 24, Liftoff.

-

Amway: It holds a strong position as the multi-level marketing leader with a notable brand like Nutrilite.

-

GNC Holdings: It has achieved an expansive reach in retail chain by focusing on vitamins and nutrition.

-

Unilever: It strongly focuses on sustainable personal care.

-

L’Oreal: It has presented innovations in skincare and dermocosmetics.

-

Procter & Gamble: It leads with its notable brands and products like Olay, Native, and Always.

-

Johnson & Johnson: It showcases a wide range of potential brands like Neutrogena, Aveeno, Tylenol.

-

Apple: The leading player in balancing the wellness through technologies.

-

WHOOP: It offers premium wearable for performance & recovery.

-

Fitbit: It highlights affordable wellness trackers and smartwatches.

What is Going Around the Globe?

- In October 2024, BharatBox announced the launch of a metaverse health and wellness platform through a partnership with GOQii.

- In November 2024, SBC Medical announced the launch of a new wellness solution named SBC Wellness to assist companies in delivering additional health benefits to achieve enhanced wellbeing of employees.

- In August 2024, Dame Health, India’s premiere reproductive, health, and wellness brand announced the launch of a gynecological health and wellness brand to resolve women’s gynecological problems and improve their reproductive wellness in India.

- In September 2024, WHOOP, the leading advanced wearable fitness and health technology company, announced the launch of its advanced wearable technology to revolutionize fitness and health coaching in India.

The Health and Wellness Market report is categorized into the following segments and subsegments:

By Type

- Products

- Services

By Product

- Weight Loss Products

- Healthy Diet

- Sports Nutrition

- Vitamin and Dietary Supplements

By Service

- Nutrition Services

- Healthy Food Delivery

- Sleep and Mental Wellness

- Fitness Centres, Equipment and Programs

By Region

North America

- U.S.

- Canada

- Mexico

Asia Pacific

- China

- Singapore

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1352

You can place an order or ask any questions, please feel free to contact us at sales@precedenceresearch.com | +1 804 441 9344

Frequently Asked Questions (FAQs) - Health and Wellness Market

1. What is the projected size of the health and wellness market by 2034?

↳ The health and wellness market is projected to reach USD 11 trillion by 2034, growing from USD 6.57 trillion in 2024.

2. What is the expected CAGR of the health and wellness market?

↳ The market is expected to grow at a compound annual growth rate (CAGR) of 5.40% from 2025 to 2034.

3. Which region held the largest market share in 2024?

↳ North America held the largest share of the global health and wellness market, accounting for 38.04% in 2024.

4. What is the fastest-growing region in the health and wellness market?

↳ The Asia Pacific region is expected to grow at the fastest rate between 2025 and 2034.

5. Which sector led the health and wellness market in 2024?

↳ The integrated wellness and personal care services sector led the market with a share of 21.72% in 2024.

6. What are the key trends shaping the health and wellness industry?

↳ Key trends include increasing health awareness, technological advancements, growing health consciousness, wellness tourism, and personalized healthcare solutions.

7. What are some of the new products introduced in the health and wellness market?

↳ Notable products include Nature’s Bounty® Intimacy Booster, One A Day® Age Factor™ Cell Defense Supplement, and Lancôme's Rénergie Nano-Resurfacer.

8. What are the major drivers of growth in the health and wellness market?

↳ Technological advancements, an aging population, rising health awareness, and supportive government initiatives are driving market growth.

9. What are the challenges facing the health and wellness market?

↳ Challenges include regulatory hurdles, supply chain disruptions, and competitive pressures, especially in mature markets.

10. What are some emerging technologies in the health and wellness space?

↳ Technologies like wellness apps, wearables, telehealth platforms, and at-home health testing kits are shaping the market's future.

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Statifacts |Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | | Towards EV Solutions | Towards Dental | Nova One Advisor

Get Recent News:

https://www.precedenceresearch.com/news

For Latest Update Follow Us:

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.